Content

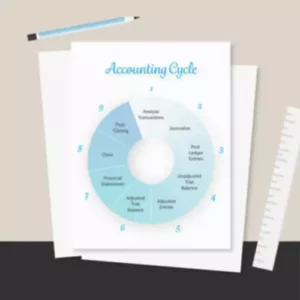

Don’t let the accounting side of running your business take up your valuable time. Wave’s software is highly customizable, allowing you to get a clear and precise view of your cash flow coming in and going out. If you’re really struggling for an answer, it’s well worth paying an accountant for an hour or two of advice. The upfront cost might sting, but it won’t hurt nearly as much as a penalty for filing an incorrect return.

What is the most profitable photography business?

- Idea #1: Stock Photography.

- Idea #2: Pet Photography Portraits.

- Idea #3: Boudoir Photography.

- Idea #4: Portrait Photography.

- Idea #5: Children Photography Portraits.

- Idea # 7: Greeting Cards and Calendars.

- Idea # 8: Professional Headshot Photos – Actors & Models.

- Idea #9: Executive Bio Photos.

Records you must keep include a receipt or proof of purchase and a note about the transaction’s purpose. Also, be sure to make all of your expense payments from a separate business bank account. Wave’s optional paid features include online payment processing, payroll software, and access to personalized bookkeeping services and coaching through Wave Advisors. If you’re interested in using payroll software, you can start a free 30-day trial when you sign up for Wave.

Can I just use my CRM for accounting?

If you hire an accountant and you stay organized, you may not need a dedicated piece of accounting software. A good photographer delivers a good invoice, with a detailed list of services rendered, travel expenses, and additional costs. Make sure you have the amount owed and a due date clearly displayed on your photography invoice.

- Proper tax planning allows a business to enjoy all of the deductions that they are entitled to.

- Whether you’re a professional photographer or just dabbling in photography as a hobby, it’s important to understand a few basic concepts when it comes to taxation and accounting.

- This doesn’t have to be anything complicated – just sit down and figure out how much money you can realistically afford to spend each month on your photography business.

- You can review a breakdown of your recent jobs, quickly check how much you’re owed in outstanding invoices, review your potential leads, and determine the growth of your business, month by month.

- The only problem with that is when you sell your house, you will have to go back and pick up ALL of that depreciation as a gain.

- I also include tips to make your expense reporting easier, such as software and apps to track expenses.

- Also, set up your business credit cards as bank accounts as well.

Fortunately, if you’re a small photography business with under ten employees there are plenty of free software options available including Less Accounting. Iris is a full-fledged project management solution with robust invoice management capabilities. If you’re a large-scale photography firm with employees working on multiple projects, you’ll need a comprehensive financial management system. Here are the best accounting software for photographers from invoicing and billing perspective.

Get support at different stages of your business journey

You can then go to that credit card website, download the transactions into Excel or Google, sort them out for tax time. Or, you can simply connect these accounts to QuickBooks Online as I explained above. Because you have only business transactions flowing through this account everything will stay super organized. I know sometimes getting started with the business might require accounting for photographers a little bit of an investment and maybe a little bit of debt. If you’re going to use a credit card to fund your business at all even if it’s a personal card, you need to have one dedicated to just business transactions. Wave’s accounting software and additional features can help shine a spotlight on growth opportunities while keeping your well-earned revenue safe and secure.

The Studio Plan is for six users and two brands and is designed for the studio with multiple employees or brands. This plan runs $40/month (GBP £29.78) annually or $60 (GBP £44.67) for a monthly plan. Those with little or no accounting experience can easily navigate the software.

– Is ZarMoney affordable for small photography businesses?

Add ons include online booking and workshop module for $7.50/month (GBP £5.58) annually or $10 (GBP £7.44) for a monthly fee. There’s a reporting dashboard that reports on every detail of your business, including bookkeeping, invoices, and business analytics. The all-in-one dashboard lets you know which tasks need to be completed for your upcoming shoot and who they are assigned to. You can also view your weekly schedule, key sales, and performance metrics.

Basically, you would reimburse yourself from the business, and then record that expense on the business at that point. While keeping a mileage log WITHOUT the odometer reading is better than nothing, much of it CAN be discredited by the IRS if you get audited and you CAN’T prove where you went and why. If you missed the first part of my interview about hiring an accountant, you can read it right here. Now you have a place to get started to finally get control of your bookkeeping once and for all.

Studio Ninja

Give ZarMoney a try today and focus on what you do best – creating stunning photographs. As a self-employed photographer, the scary truth is that you now have a bigger tax responsibility. But the good news is that you are also entitled to deducting photography business expenses from your taxes. In this blog, https://www.bookstime.com/ tell you what business expenses are and what you can write off as a photographer. I also include tips to make your expense reporting easier, such as software and apps to track expenses. Finally, scroll down to the bottom to download a free spreadsheet to track expenses to use for your own business.

Examples would include the costs for travel, renting equipment, hiring a photography assistant, etc. Alongside goes saving all the receipts and invoices so you can have tangible evidence. This will make it easier to track your expenses as well as prepare your tax return. One of the best ways to stay on top of your expenses is to create a budget.

Exploit Invoicing and Accounting Software

Knowing your tax laws will help you be prepared in case you ever have to go through a tax audit. Click here to read 3 Tax Audit Tips Every Photographer Should Know Before Ever Being Audited!

For a free option, Flowlu is a solid choice for photographers looking to do simple accounting and tracking their finances. For some photographers, dealing with taxes can be a complicated and stressful process. There are a lot of rules and regulations to keep track of, and it can be hard to know which deductions and credits you’re eligible for. But the more you know about a topic, the less daunting it becomes. Hopefully the basic information in this article points you in the right direction and gives you a good starting point from which you can make some basic decisions and do further research.