Content

Pricing for BooksTime services begins at $355.00 per month for companies processing up to $25,375.00 in monthly expenditures. Rates for more comprehensive services and add-ons require a consultation. Businesses can count on Rigits to help manage company credit cards with statement reconciliations that account for every penny. For companies with contractors on the payroll, Rigits can maintain your 1099s and process them at year-end as part of their convenient, helpful tax services.

Small businesses and startups need a way to pay their vendors, a way to collect money from customers, and a way to have reliable financial information to make critical business decisions. All of these can be a lot of workload for small businesses and startups and that’s where cloud-based accounting firms like Tristan CPA Boston can help you ease the process. As a family-owned firm, Steel Breeze comes with over 40 years of combined experience in bookkeeping and accounting. Beyond bookkeeping, payroll, and tax preparation, this firm also offers CFO services to help guide small companies to their best results, whether that includes keeping business steady or determining how to make it grow.

Want to Talk? Call Our Office Today for a FREE Consultation: 877.455.1040

Our services are streamlined for small business and startups in Boston, Massachusetts who would rather spend time growing their business than doing the numbers. In addition to accounting services and financial statement preparation, this firm specializes in tax-exempt businesses, an excellent feature for charitable organizations needing quality bookkeeping. For the more complicated financial matters a business https://www.bookstime.com/ can face, Marcum can handle wealth management to maximize your assets and bankruptcy and insolvency issues should a company find itself in a dire situation. With BooksTime, clients pair up with dedicated bookkeepers with experience in the client’s industry and knowledge of the most up-to-date bookkeeping software. The company’s 100% Accuracy guarantee ensures the integrity of all accounts and reports.

- We’ll also design and implement tax planning strategies to reduce taxes and reveal higher profits.

- You will confidently make important financial decisions for your business knowing that your accounting processes are overseen by the qualified professionals at our local Boston CPA firm.

- You can rely on us for access to the critical financial data you need to run your business, watch expenses, and look for opportunities to grow, without the demanding accounting tasks.

- It can be a balancing act of optimizing the service level that our clients need, so we consistently check in on what our clients are doing and how we can better serve them.

- BooXkeeping will make running your business in Tampa smoother than ever with our team of U.S.-based experts handling day-to-day bookkeeping tasks and integrating seamlessly into your existing accounting software.

- By taking the customer collections off of you, we can get you to that pay day without ruining relationships with customers.

Bookkeepers in Boston come in various shapes and sizes, from individual CPAs to full accounting and tax teams. Businesses have a healthy selection of services that covers vast needs. Whether your company needs help with day-to-day transactions or requires a more comprehensive growth strategy, you can find affordable, high-quality bookkeepers in Boston that fit the bill. BFA, LLC is one of the more comprehensive professional bookkeeping services in Boston. This firm covers functions from outsourced bookkeeping and notary services to business audits to help you fine-tune your operation.

Boston’s Premier Remote Bookkeeping Team

Our online bookkeeping services Boston keep you updated with balance sheets, profit & loss statements at the end of every month, and an

easy-to-access dashboard that displays business trends over time. Businesses needing accounting professionals can tap into BFA, LLC’s bookkeeping and financial statement. If you are buying or selling a business or starting a new enterprise, this firm is available to help. To ensure an organization is ready to carry its tax burden, BFA, LLC helps with planning and preparation. Supporting Strategies provides outsourced bookkeeping services, controller services and operational support to growing businesses.

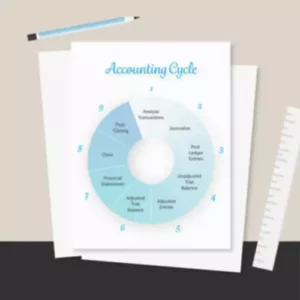

While bookkeeping is to record day to day financial activities, CPA firms help to analyze and summarize the report of everything collected by the bookkeeper. Anyone needing tax processing for individuals or businesses of any size can also find services at Edelstein & Company. A comprehensive list of offerings makes it easy for businesses to get all necessary services in one place.

Favorite Boston Coffee

Their interim CFO service provides access to financial professionals who can guide complex financial considerations, such as business strategy and cash flow maintenance. As a small business bookkeeping service in Boston, Nativance is all about workable solutions. This company specializes in helping https://www.bookstime.com/articles/bookkeeping-boston nonprofits with their nuanced bookkeeping needs and startups navigate areas like business growth and process improvement. We support and work with most major accounting and bookkeeping software platforms, making it easy to outsource to us and keeping you in control of your financial data.

These services can range from monthly accounting, GAAP audit/GAAP compliance, and chart of accounts review, among a slew of other services. Not many small companies are same, therefore our digital accounting services Boston are made bearing in mind that the scalability and market industry demands of your companies. Also, they should have good communication skills and be able to analyze information in such a way that it’s easy for everyone to comprehend. Another service added was a package that allowed the payroll company to print the checks, sign and stuff them, and reconcile the uncashed checks on the account.

Jennifer Hoernlein, BS, CPA

Free yourself from the time consuming and error prone tasks of bookkeeping. We have a pricing matrix for all of the products that we offer — and we list this structure on our website! The market is the market, and we believe that there’s no point in hiding fees or creating connections without pricing expectations.

Treeful Damaso Aniceto, Inc. is a member of the American Institute of Certified Public Accountants. It also provides payroll services and tax preparation, as well as assisting with the formation of small to large-scale companies. SmartBooks is a bookkeeping firm that has been serving small to medium-sized businesses across the US for over seven years, with headquarters in Concord and a location in Boston. Dimov Tax Specialists provides bookkeeping solutions to businesses in Boston. It also offers to compile, review, and audit financial statements for various entities, from LLCs to corporations and partnerships. With more than a decade of expertise, Dimov Tax Specialists also advises clients on business valuation and offers M&A consultation.