Contents:

Low DSO is a desirable metric, so long as you’re not rushing vendor payments at the expense of optimizing growth. Companies typically measure DPO on a quarterly or annual basis. How well you balance these two activities goes a long way to solidifying financial health for the long term. Every business engages in the balancing act of taking in revenue and paying the bills.

Now, imagine that it’s not a person that purchases the electricity on a loan, but a company. Additionally, on the balance sheet, accounts payable falls under the current liabilities section. Keep in mind the word ‘current’ so any long-term liabilities are not included. Accounts payable refers to the account representing a business’ obligations to pay off liabilities towards suppliers or vendors.

What Is Days Sales Outstanding? – The Motley Fool

What Is Days Sales Outstanding?.

Posted: Thu, 06 Apr 2023 07:00:00 GMT [source]

Discount calculator uses a product’s original price and discount percentage to find the final price and the amount you save. Using any of these tips will increase your DPO, offering your company better flexibility to make the most of its available resources. Before you make improvements in your DPO numbers, taking stock of where those numbers are currently is essential. DSO sometimes goes by the names Days billing outstanding or Days Receivables outstanding . DPO that is too high indicates a business is struggling to meet its obligations or has a cash shortfall. For the beginning balance report, we should date our report as of December 31 of the previous year.

What do Days Payable Outstanding (DPO) show you?

Make it over 30 opportunities whenever possible for statistical significance, and as big as possible within the resources available for the study. Determine the types of defects you are including in the study and in which parts of the process they occur. Focus on common causes of failure versus special causes of failure.

- Paying as late as possible can jeopardize a company’s relationship with its vendors.

- In the above, over simplified example, we are assuming that Ted has to pay $100 in 10 days to his vendors and he will receive $100 from his customers in 5 days.

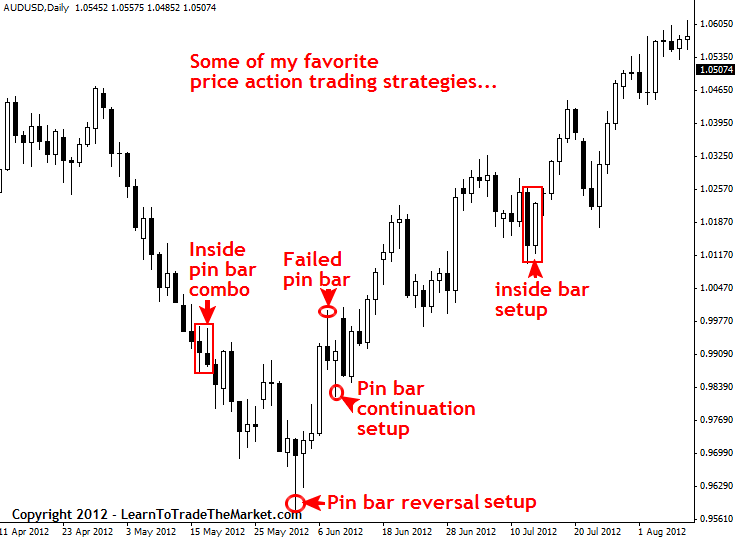

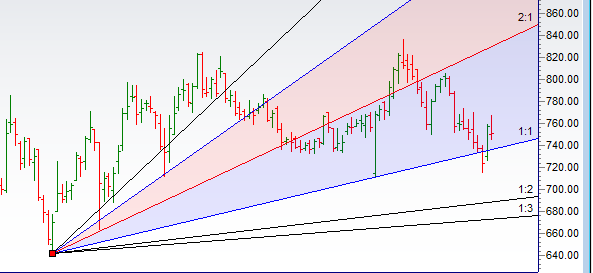

- Cycles can be estimated by counting the periods between peaks or troughs.

- The Percentage Price Oscillator is better suited to identify overbought and oversold levels.

Days Payable Outstanding refers to the average number of days it takes a company to pay back its accounts payable. Therefore, days payable outstanding measures how well a company is managing its accounts payable. A DPO of 20 means that, on average, it takes a company 20 days to pay back its suppliers. Days payable outstanding is an efficiency ratio that measures the average number of days a company takes to pay its suppliers. Cash Conversion CycleThe Cash Conversion Cycle is a ratio analysis measure to evaluate the number of days or time a company converts its inventory and other inputs into cash. It considers the days inventory outstanding, days sales outstanding and days payable outstanding for computation.

Definition – What is Days Payable Outstanding (DPO)?

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Therefore, it is safe to assume that there are 365 days in an accounting period. New and existing suppliers see companies with a well-balanced DPO average as trustworthy and reliable. This can make it easier to negotiate good terms and secure discounts in the future . Using these metrics in concert with other activity metrics helps paint a full picture of the data contained in financial statements for data-informed decision-making. They can be calculated for any time period, but most often on a 365-day basis.

Arria-formula Meeting: Protection of Water-related Essential … – Security Council Report

Arria-formula Meeting: Protection of Water-related Essential ….

Posted: Tue, 21 Mar 2023 07:00:00 GMT [source]

It shows how many days, on average, it takes a company to pay for goods and services that were purchased on credit. In many businesses, the days sales outstanding number can be a valuable indicator of the efficiency of the business and the quality of its cash flow. If the number gets too high, it could even disrupt the normal operations of the business, causing its own outstanding payments to be delayed. A company needs raw materials, utilities, and other resources to make a product that can be sold.

Days payable outstanding and the cash conversion cycle

This could lead to supplier disputes and other financial problems. Days payable outstanding is the average number of days it takes for a company to pay its suppliers. This calculation requires the accounts payable, cost of goods sold, and the number of days variables. From this result, we can estimate that, on average, it takes 48.67 days for the company to pay off each of its accounts payable to its vendors and/or suppliers. Keep in mind that this number does not tell us the bigger picture since there’s no ideal number of DPO. To get a better outlook, you can compare the result to other companies within the same industry and the same period.

On the other hand, reducing DPO can be advantageous if it means the company wins greater supplier discounts. If a company waits until the last minute to pay its bills, it can use the cash in the meantime on other programs. For example, the company may be able to use cash to pay other business expenses instead of borrowing money, thus avoiding interest costs. Some companies determine DPO based on the AP balance at the end of the period, while others use the average balance during the period.

Defects per Opportunity: 5 Steps to Caluculate DPO

If a company’s ability to make its own payments in a timely fashion is disrupted, it may be forced to make drastic changes. The definition of a good DPO depends on many factors and differs by industry. Generally speaking, a good DPO is one that allows a company to improve cash availability while also keeping its vendors satisfied. DPO is also a sign of how much power a company has in the marketplace. Companies with large market share will represent higher potential revenue to vendors, so they may have additional leverage to pay more slowly.

- DPOs vary by industry, so comparison with your peers can be useful.

- Companies with high DPOs have advantages because they are more liquid than companies with smaller DPOs and can use their cash for short-term investments.

- That said, the definition of “quickly” depends on the business.

- There is a link between the number of opportunities and defects.

Given the vital importance of investing activities include flow in running a business, it is in a company’s best interest to collect its outstanding accounts receivables as quickly as possible. Companies can expect, with relative certainty, that they will be paid their outstanding receivables. But because of the time value of money principle, time spent waiting to be paid is money lost. Days sales outstanding is the average number of days it takes a company to receive payment for a sale. Focusing on tracking and optimizing DPO helps a company better manage all-important cash flow. Increasing the number of days taken to pay vendor invoices helps the finance team ensure more cash is available to fund operations.

What is a good days payable outstanding ratio?

If the company is tight on cash, it will look to the finance team to extend DPO as long as possible. DPO is a key factor in the company’s cash conversion cycle, which measures its ability to quickly convert resources into cash. Determine COGS. COGS is calculated by adding the costs of materials, labor and other expenses directly attributable to the creation of the company’s products and services during the period. The Six Sigma metric that we’re discussing today is Defects-Per-Opportunity, which is abbreviated as DPO. Before moving on to DPO, let us first define the term ‘opportunity.’ ‘Opportunity’ in the Six Sigma methodology refers to the chances to commit errors.

Working https://1investing.in/ management is a strategy that requires monitoring a company’s current assets and liabilities to ensure its efficient operation. By using electronic payment systems, a company can streamline its payment processes and make payments more quickly and efficiently. This means that instead of issuing slower means of payment such as a check that may have to be processed and mailed early in order for it to be received in time. Instead, a company can issue electronic payments the instant something is due. DPO often varies by industry or company size, as larger companies often have more negotiation power to delay when payments are due. When comparing DPO between companies, it’s important to remember that practices can vary considerably between different industry sectors and geographical locations.

Killers of my son yet to be arrested 2 months after death — Onitsha widow laments – Vanguard

Killers of my son yet to be arrested 2 months after death — Onitsha widow laments.

Posted: Thu, 13 Apr 2023 18:40:35 GMT [source]

With fast calculations within Excel, your team can get a handle on the data and make data-informed decisions to drive the business forward. Others pay on an accounting period that is monthly, bi-monthly, or quarterly. Large companies often have more bargaining power and thus better DPO calculations.

Even if you’ve had difficulty with payments in the past, as your overall financial situation improves, suppliers may be more willing to extend credit terms. Compare your DPO to the standard payment terms in your industry. If most suppliers allow payment within 30 days , then your optimal DPO should be less than 30 days. If it’s substantially less, perhaps you’re paying your suppliers sooner than necessary or your suppliers aren’t offering you the industry-standard net30 payment terms. Now let’s make the example a little more complicated and include money that Ted will collect from customers.